The NTX Wealth Journey

NTX Wealth merges sophisticated financial coaching, innovative technology, and disciplined investment management, uniquely tailored to align our clients’ values with their financial priorities. Our real-time financial planning software enables informed decision-making, in-depth tax planning, and robust investment portfolio management for confidence when clients need it most.

The advantage of NTX Wealth lies in our team approach – our clients benefit from collective expertise rather than relying on a single individual. We are more than just CERTIFIED FINANCIAL PLANNER™ professionals; we are strategic partners.

Our Services

Click On The Tabs to Learn More

Our Approach

We start with your “why.” We believe your financial goals should be carefully calibrated to your values. In this way, wealth becomes a tool that propels you forward in the right direction – in the pursuit of what matters most to you. Life planning is like preparing for a vacation. You start by brainstorming all the experiences you’d like to have and memories you’d like to create to the point where you can clearly visualize and feel what that vacation would be like. That vision and excitement propels you to take action and overcome obstacles – like booking all the reservations – to make your ideal vacation a reality. In a similar way, life planning helps you overcome your obstacles to work toward making your ideal life a reality.

Our Process

The 3D Assessment™ is our introductory conversation led by one of our CERTIFIED FINANCIAL PLANNER™ practitioners designed to uncover your “why” and help you visualize and pursue what matters most to you.

-

Define your values

This is the brainstorming phase – no wrong answers or limitations exist. We have a series of engaging exercises that bring out the heart of what truly matters most to you. Most people find this step energizing you might even surprise yourself with some of your responses. -

Develop your vision for your future

In this step, we solidify what your ideal life looks like. Carefully combining your values into a coherent vision, you’ll now begin to feel the excitement of what it would be like to live your ideal life. -

Discover your path forward

Now with a clear vision and renewed energy, we create an action plan and practical steps you can take to begin addressing each of the obstacles getting in your way. Many people enjoy this step the most as they experience meaningful progress toward their ideal life.

Our Approach

We believe your financial plan should continually answer the question: “Am I on track?” As a live, real-time analysis, your financial plan should give you clarity on your progress toward your goals, even in the most rapidly changing environments. Contrary to most one-time, static plans, a dynamic plan gives you actionable steps to keep your strategy on track when times get tough.

Setting up a financial plan is like being given a GPS device when you’re lost. It tells you exactly where you are and how to get where you want to go and adapts in real-time. Much like GPS, it forecasts your path, alerts you as potential obstacles arise, and outlines recommended routes to your destination.

Our Process

Our financial planning process utilizes WealthVisions™ technology to enable collaboration between the planner and the client. We empower our clients with tools to visualize the outcomes of different possible choices and help them optimize their decisions.

Access and Aggregation

- Interactive client portal

- Live asset values

- Consolidated net worth

- Mobile, on-demand access

- Spending and budgeting

- Customizable budgets by category

Planning and Forecasting

- Robust what-if scenario planning

- Comprehensive tax calculations

- Collaborative cashflow and retirement income planning

- Estate and legacy planning

- Social Security optimization strategies

Tracking and Reporting

- Screenshare collaboration with your planner

- Investment performance

- Income and expense tracking

- Client Vault secure document storage

- Data-driven decisions

- Alerts and tasks

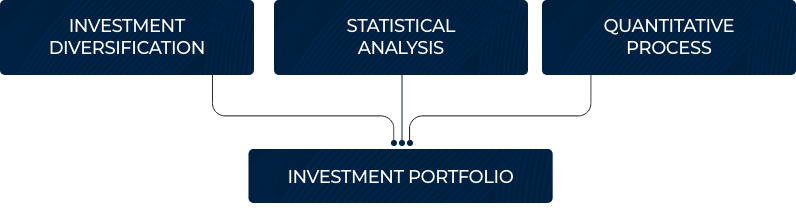

Our Approach

We believe that long-term, diversified, and low-cost investments coupled with a disciplined decision-making process result in a better investment experience. Investment management should be like a fine dining experience, where the highest quality ingredients are combined with the right recipe and cooked to perfection through a disciplined, consistent process.

Our Process

Our investment committee meets regularly to review portfolio performance, perform due diligence on investment holdings, and analyze third party research and quantitative data that drives allocation adjustments.

-

INVESTMENT SELECTION

Ingredients Matter

We are committed to only allowing the highest quality investments into our clients’ portfolios. In pursuit of consistent excellence, we use an 8-factor screening process to create a profile of each potential investment holding and rank them by factors including volatility, return, cost, and comparison to peers. Our portfolios of low-cost, liquid ETF’s represent the cream of the crop from each asset class.

-

PORTFOLIO CONSTRUCTION

The Right Recipe

Now with only the highest quality investment holdings, we then seek to combine those investments in such a way to maximize diversification. Most portfolio managers only think about diversification in terms of investment asset classes, but our portfolios are carefully curated to not only diversify asset classes, but also the mathematical lenses through which allocation decisions are made over time.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

-

PORTFOLIO MANAGEMENT

Disciplined Execution

There are times when slight over- or under-weighting of certain asset classes can benefit your portfolio. To ensure consistency in execution over time, we believe that any modification of the portfolio ought to be based on predefined, measurable criteria. We harness the power of four analytical lenses, or elements, to ensure our portfolio management is definable and repeatable.

Click on one of the four lenses to learn more about it

TREND - harnesses the concept that price momentum tends to persist for extended periods of time.

VOLATILITY - uses implied market volatility as a potential signal for upcoming equity market volatility.

CONTRARIAN - tracks fundamental valuation metrics like P/E ratio to determine attractive buying opportunities.

ECONOMIC - based on an assessment of over 200 economic data points to determine the health of the overall economy.